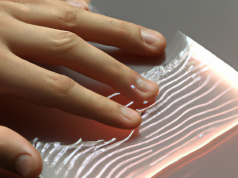

Focused on creating the next frontier of surgery, Johnson & Johnson (NYSE: JNJ), today announced that Ethicon, Inc., entered into a definitive agreement to acquire Auris Health, Inc. for approximately $3.4 billion in cash. Additional contingent payments of up to $2.35 billion, in the aggregate, may be payable upon reaching certain predetermined milestones. Auris Health is a privately held developer of robotic technologies, initially focused in lung cancer, with an FDA-cleared platform currently used in bronchoscopic diagnostic and therapeutic procedures. This acquisition will accelerate Johnson & Johnson’s entry into robotics with potential for growth and expansion into other interventional applications.

“In this new era of health care, we’re aiming to simplify surgery, drive efficiency, reduce complications and improve outcomes for patients, ultimately making surgery safer,” said Ashley McEvoy, Executive Vice President, Worldwide Chairman, Medical Devices, Johnson & Johnson. “We believe the combination of best-in-class robotics, advanced instrumentation and unparalleled end-to-end connectivity will make a meaningful difference in patient outcomes.”

With this acquisition, Frederic Moll, M.D., CEO and Founder of Auris Health and a visionary in the field of surgical robotics, will be joining Johnson & Johnson upon completion of this transaction.

“We’re thrilled to be joining Johnson & Johnson to help push the boundaries of what is possible in medical robotics and improve the lives of patients across the globe. Together, we will be able to dramatically accelerate our collective product innovation to develop new interventional solutions that redefine optimal patient outcomes,” said Dr. Moll. “This combination is a testament to the incredible work of the Auris Health team and the innovation engine behind the Monarch Platform, which represents a huge step forward in endoluminal technology. We look forward to continuing to shape the future of intervention with the added expertise and resources of the world’s largest healthcare organization.”

Johnson & Johnson is continuously working to disrupt medical innovation. With Auris Health’s current focus on lung cancer, the Monarch Platform robotic technology will play an important role within the Lung Cancer Initiative at Johnson & Johnson (LCI), enabling the development of a differentiated digital solution that addresses key steps in the lung cancer care journey, from diagnosis to early stage intervention, that are central to the company’s commitment to develop solutions that prevent, intercept and cure this deadly disease.

Johnson & Johnson continues to make meaningful investments to transform the surgical experience, connecting digital solutions to enhance surgical performance. In addition to advancing the company’s focused initiatives to combat lung cancer, Auris Health’s technology will support Johnson & Johnson’s vision of being a world leader across the continuum of surgical approaches, including open, laparoscopic, robotic and endoluminal. This move is also complementary to the acquisition of Orthotaxy’s robotic technology for orthopaedics and the continued development of the Verb Surgical Platform, through a strategic partnership with Verily.

“We are very committed to our partnership with Verily on the development of the Verb Surgical Platform. Collectively, these technologies, together with our market-leading medical implants and solutions, create the foundation of a comprehensive digital ecosystem to help support the surgeon and patient before, during and after surgery,” said Ms. McEvoy.

Johnson & Johnson is creating a connected digital ecosystem centered around using data to improve patient outcomes that leverages world-class robotic technology. This ecosystem will empower patients to take charge of their health, guide surgeons through procedures and help them advance their skills and enable healthcare systems to deliver more consistent procedures while also managing costs.

The closing is subject to antitrust clearance and other customary closing conditions. The transaction is expected to close by the end of the second quarter of 2019. The company will discuss the transaction further during its next quarterly earnings call on April 16, 2019.