Sun Tzu wrote in his timeless tome, “The Art of War,” from centuries past, that one can accomplish remarkable feats with minimal resources.

This saying is so widely known it is almost a proverb. It appears that the US is not convinced that minor activities are enough to secure a lead on China in the area of AI and machine learning technology.

Following the implementation of significant prohibitions on the sale of semiconductors to China in October, the recent agreement between the U.S. and Japan and the Netherlands which restrict the exporting of vital semiconductor parts and chip-making technologies to China is causing distress and disruption in the $600 billion international semiconductor market.

The impact of these regulations is wide-reaching as China is responsible for the creation of around 80% of the electronic goods worldwide and is a main purchaser of semiconductors. It is even more difficult to understand as nearly all of the leading chipmakers have purchasers in China.

Washington does not seem to be troubled by the anxieties of global semiconductor manufacturers or short-term supply chain unpredictability. Instead, it is focusing on the long-term: it is trying to impede China’s capacity to create and have access to Artificial Intelligence while broadening its sources of the progressively vital integrated circuit.

Josep Bori, research director at GlobalData, affirmed that the U.S. has been making assertive steps to acquire supremacy in AI and to maintain its global economic control in the long run, which has been coined as the fifth industrial revolution.

The most recent agreement involving Japan and the Netherlands, prohibiting the exporting of older ultraviolet (DUV) technology as well as perceived advanced AI chips, is specifically targeting the Chinese semiconductor industry and its capacity to develop its AI related expertise, according to Bori.

It is impossible to make pancakes without a pan.

China manufactures many different types of semiconductors, but it lacks the latest technology required to construct the most efficient processors, chips, and memory storages.

Many businesses in the nation bring in a great deal of integrated circuit and apparatus from corporations throughout the world, like TSMC from Taiwan; Intel, Nvidia, and AMD from the U.S.; SK Hynix and Samsung from South Korea; ASML Holdings from the Netherlands; and Nikon and Tokyo Electron from Japan.

To a large degree, Chinese companies such as Semiconductor Manufacturing International Corporation (SMIC) are greatly dependent on the rest of the world’s semiconductor market in order to acquire the necessary equipment to produce more advanced processors.

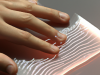

Bori claims that many of the high-end processors and RAM chips are created utilizing deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography devices.

At the beginning, the restrictions on United States exports to China only applied to EUV machines, which are used in the top of the line process nodes such as 3 nm, 5 nm, and 7 nm, Bori stated.

This suited the U.S. plan of restraining the progression of Chinese organizations in AI, artificial intelligence, and other advanced innovation. Basically, the closer together the transistors are, the more proficient and faster the chip will function. Smallest progression nodes, like 3 nm, 5 nm, and 7 nm, are applied to create artificial intelligence systems, mobiles, cloud data centers, autonomous autos, and military operations.

An accord in January aims to direct older DUV technology, which could enable the fabrication of 14 nm processors, in addition to 18 nm DRAM memory and NAND flash chips with more than 128 layers, as outlined by Bori. This type of tooling enables chips to be fashioned at 14 nanometer, 28 nanometer, and bulkier process steps, and these parts are regularly utilized in autos, industrial apparatus, and domestic appliances.