A heated argument exists in the realm of logistics robotics. Greenfield believers argue that the best experience is created with automated systems being the main focus. However, Brownfield advocates emphasize the need for money and time for a total reconstruction. Many companies that want to automate their warehouses may not have the ability to start over from the beginning.

Most individuals eventually settle on a mix of these strategies. Of course, one size doesn’t fit all. Now, Nimble is revealing plans for its own third solution. It’s a system that allows businesses to outsource their warehousing demands through completely automated third-party logistics (3PL) facilities.

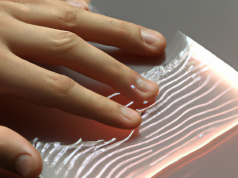

According to Simon Kalouche, the CEO and founder of Nimble, the pick and pack robotic automation firm that launched in 2017 did not initially have the new model in mind. Kalouche told TechCrunch, “This developed as we got more familiar with the industry. I have visited many warehouses and noticed that everybody is automating all the other aspects of the warehouse, but the picking process is still the most difficult one.” Until you introduce automation into the picking process, you will need employees in the warehouse. You must make sure the warehouses are designed to be ergonomic, secure, and up to standard with Occupational Safety and Health Administration regulations for people. When automation is used for the picking step, all of these considerations are no longer necessary.

Kalouche stated that the company had already started to utilize third-party fulfillment centers, opening the first one about a year ago. He did not say how many centers are active, only that the number is “somewhere between one and ten” and they are spread out in the U.S. The press material explains that their “intelligent robotic fulfillment systems” will pick, pack, and send out e-commerce orders while decreasing the warehouse space by up to 75%. Nimble’s network of automated warehouses will give companies access to more than 96% of the population of the United States within one to two days, as well as up to 40% savings when compared to traditional third-party logistics providers.

Though it does not involve same-day delivery, the development of third-party warehouse automation is helping online stores compete with Amazon’s massive presence. This technology offers a chance to even out the playing field to some extent, and Amazon also has its own growing number of robots to make use of.

Nimble has benefited from their autonomous systems, yet they have not yet attained a fully automated factory. Kalouche states that there are still manual operations and they are striving to achieve a ‘dark warehouse’, though they are not there yet. However, the picking process is already an automated function.

It is clear that the shift towards full automation of American factories has further implications. Amazon recently announced that they are running low on human labor, and many warehouse managers have explained their struggle to hire during the pandemic. However, the impact of partial and full automation on the job market is drastically different.

The dispersion of the dispatch center makes delivery much faster due to items being closer to buyers. Kalouche states that they are adopting a calculated, measured strategy when it comes to the amount of depots. The eventual aim is to collaborate with a wide assortment of business sizes, ranging from large-scale to Etsy vendors (Kalouche suggested Shopify traders, but I like the sound of alliteration better), and the capacity to serve a number of clients in a single warehouse should assist.

In the interim, Nimble is concentrating on middle-level retailers, though they won’t divulge the names of these customers. We could say they are between Walmart and your cousin’s eBay store. Nimble will keep on backing current clients, yet the introduction of these mechanized fulfillment centers has them generally moving away from their earlier system of retrofitting existing warehouses.

The startup’s development is being propelled, in part, by a $65 million Series B driven by Cedar Pine, with contributions from DNS Capital, GSR Ventures and Breyer Capital. This is after a $50 million Series A almost two years ago, bringing their total funding up to around $110 million. Nimble isn’t ready to discuss their valuation yet.

“We found Nimble’s AI robotic technology and 3PL fulfillment capabilities to be hugely impressive due to the growth of E-commerce and warehouse automation, as Stephen Weiss from Cedar Pines stated in a statement about the news. Our comprehensive research demonstrated that Nimble is significantly more advanced than existing competitors and has the potential to be the foremost provider in the industry.”

Nimble is being careful to not increase their staff size drastically in the near future, but are still recruiting new members. Kalouche commented, “We’re not trying to dramatically expand our employee base in the next year, but we are looking for new people.”