Current Surgical, based in Washington D.C., declared a $3.2 million startup fund this week, which, joined with other funds raised by the corporation, sums up to $4 million. This money was group funded by True Ventures, 1517 Fund, and SciFounders. It will help pay for the recruitment of 6-8 engineers over the next 2 years, with specialties in electrical, mechanical, and ultrasound.

The firm has informed TechCrunch that the seed funding granted provides the necessary funding to build the crew to create a practical adaptation of their device that can be tried out with clinical associates in a preclinical environment. Additionally, they will be consulting with the FDA to ensure that the procedures and tests for their technology comply with regulatory norms.

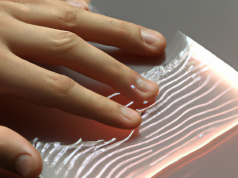

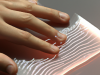

Current is developing a “smart needle” that can be employed to target cancerous tumors without the need for surgery that could damage other organs, or chemotherapy and radiation that have their own shortcomings.

This technology draws on the existing application of needles, which utilize thermal ablation to eradicate cancerous clusters, although these techniques are not as accurate as other approaches.

Current expresses enthusiasm for the technology that has been developed, noting that its small size yet highly accurate capabilities make it possible to treat tumors with precision and assurance almost anywhere in the body. To ensure effective results, he mentions they are in the process of creating a technologically advanced framework with the incorporation of cutting-edge ultrasound detectors that enable medical personnel to see and destroy tumors without detriment to healthy tissue.

In 2020, Alireza Mashal and Chris Wagner established Current, with the former acting as CEO and the latter as CTO. They have prior business experience in start-ups. This newly created software-enabled surgical platform plans to tackle issues that go beyond tumours, such as heart rate irregularities, chronic pain, and protracted pains.

At the beginning of the summer when we held meetings with investors, we observed a hesitation that was not present when we approached investors for money prior to the pre-seed raise in the end of 2020 and beginning of 2021. This made it simpler for us to recognize investors, for instance True Ventures, who are able to devote in high-potential, long-term ventures even though there is a certain amount of short-term ambiguity. Since we are striving to shift the way surgery is done, a process which cannot be achieved in 1-2 years, we are delighted to have found investors who share our high level of aspiration and foresight.