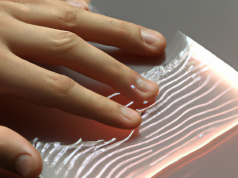

Masaya Aso, who worked on autonomous driving technology at Bosch in Japan and Germany, noticed that very few warehouses have automation, with more than 85% having virtually none.

Aso established LexxPluss, a Japan-based organization that specializes in the production and engineering of autonomous mobile robots intended to convey loads and enhance operations within warehouses and logistic centers, two years ago in response to the issue.

Aso, the leader of the company, started it with experienced professionals from Bosch, Amazon, Honda, and others. The Japanese business is ready to start up in the U.S. with a large injection of $10.7 million (1.45 billion JPY), which values the company at about $38.8 million (5.26 billion yen).

The most recent investment was headed by Drone Fund and supported by HAX from SOSV, Incubate Fund, SBI Investment, and DBJ Capital.

At the beginning, LexxPlus concentrated on the logistics and automotive manufacturing sectors since those businesses are starting to place robots in places other than on their production lines. Its primary customers are in Japan in the logistics and automotive areas; a few of the present automotive parts producers have plants in the United States, Aso stated. It hopes to use its present clients’ connections to enter the U.S. market. The autonomous mobile robots market – the biggest one globally – was already worth $762 million in 2021 and is anticipated to expand to $3.2 billion by 2028, which would make up around 40% of the global market size.

Besides enlarging its presence in the United States, Aso mentioned that the Series A funding would help the firm advance its product, enabling it to carry 500kg (a much sought-after feature wished by e-commerce operators), and adding a 3D rendering of an operations’ “digital twin” for control and monitoring from a distance.

Regarding its rivals, OTTO Motors, OMRON, and Locus Robotics have all developed self-governing robots. According to Aso, LexxPluss is distinct due to its higher capacity (as much as 500kg) and more open mechanical design IPs and APIs, which assists with customers’ integration and upkeep. He highlights that some of the competitors usually have closed IP, which is a problem for their customers.

Aso stated that they disclose a great amount of technical information so their partners can get a thorough understanding of their technology, how to put it into practice in their warehouse or factories, and maintain it by themselves. The objective of this is to make everything more transparent and to simplify the process of working together.

The startup began its sale approach in the previous year and currently has seven customers and 32 partners, which are included in a public mechanical robotic system that was initiated last June. Aso told TechCrunch that the system is intended to increase cooperation with mechanical robotic organizations by making accessible a lot of their technical information, including 3D CAD design, electrical design, embedded software, production process records, deployment tools, maintenance documents, APIs, and more.

The business at present produces revenue using either a monthly payment plan or a payment split into two installments, with half paid at the beginning and the other half every month, as Aso pointed out.

The investors of the company are confident that they have a strong opportunity to get a substantial portion of a large market. Recent research predicts that the market for autonomous mobile robots will be worth $8.70 billion in 2028, compared to $1.97 billion in 2021.

Duncan Turner, a general partner at SOSV and the managing director of HAX, noted that LexxPluss has an immense benefit over other warehouse automation companies because of the large technical team they have in Japan, which is venerated in both industrial robotics (representing 37% of the global market) and the automotive sector (35% of the U.S. automotive industry).

The expertise they possess, as well as the knowledge they have gained throughout the years in their field, will assist them in penetrating the U.S. market where a smooth connection is essential.