The prices for insurance have gone up significantly over the past year due to inflation. Bankrate.com reported a 13.7% increase in auto insurance premiums nationally, and Policygenius discovered a 12.1% increase in home insurance rates.

However, Jonathan Matus believes it does not need to be this way. He created Fairmatic, an organization applying AI to allegedly decrease risks within the car insurance field.

Matus previously established Zendrive, a system that offers understanding to businesses for vehicle protection underwriting and cases and also roadside help. While Zendrive is centered around protection for individuals and families, Fairmatic has a more commercial point – mainly made up of organizations as its customers.

After ten years of being employed at Google and Facebook, Matus observed the bad effects that the technology he had a hand in widely distributing had on people. This led to the development of Fairmatic, in order to tackle the problem of people using their phones while driving and the resulting fatalities. Matus expressed this in an email to TechCrunch.

Matus might use big words, but what Fairmatic does is straightforward: evaluating and pricing the danger of a vehicle fleet. They use AI models that are based on driving data to try and reduce risk as well as help with different policy management and claims processes.

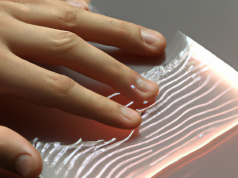

Clients are able to download a program that they can use to track patterns in their driving, such as instances of reckless behavior, and explore ways to increase their safety. The app also provides a completely digitalized process for filing claims in the case of a crash, which can be automatically detected with more accuracy than what Apple is able to provide.

Matus states that Fairmatic provides useful data to small, medium, and large businesses that aids in increasing safety, as well as reducing insurance costs.

However, caution is warranted. Fairmatic is not the initial business to utilize AI in automobile insurance decisions – Jerry, Just, Root, and Tractable are furnishing similar services, mainly to customers – and AI has not been successful in the insurance sector in the past.

Last year, the Casualty Actuarial Society (CAS) – the organization of actuaries specialized in property and casualty insurance – noted the potential bias of Artificial Intelligence (AI) when employed by fiscal institutions in the fields of insurance and mortgage lending. In a series of documents, the CAS confirmed that data containing prejudice – the info used to train the algorithms of insurers – could continue to uphold discrimination present in the insurance sector. Examine Allstate’s pricing system, which had a detrimental effect on customers of color.

A subsequent report from the California Department of Insurance identified certain AI applications used by insurers that raised concerns, such as targeting claims from urban areas and using personal details that were not related to risk in the marketing and assessment of insurance policies. The report’s authors stated that “bias or discrimination, conscious or not, can and often does result from the use of AI and other forms of ‘big data’.”

Washington and Oregon are attempting to prohibit the utilization of credit-based scoring calculations to set vehicle protection premiums. In addition, Colorado has proposed a law stipulating that insurers must evaluate their algorithms and scoring models to discover discriminatory practices.

Matus is very insistent that Fairmatic does whatever it can to stop the chance of prejudice in its AI. In fact, he believes that Fairmatic’s utilization of AI can often provide better results for consumers, who have previously been restricted to using insurers who depend on obsolete data and cost structures.

He noted that Fairmatic’s AI predictive risk model is based on more than 200 billion miles of driving data, which enables them to build a much more thorough and individualized risk profile for each fleet and driver. This information is then used to provide guidance and assistance to drivers so they can drive more safely and decrease the risk of accidents.

Despite Fairmatic’s approach being better than many out there, the platform’s capacity to track drivers is still a cause of concern. It has similarities to how Amazon has employed algorithms to observe delivery drivers whilst they are at work. As reported by Vice, the algorithms were wrongly penalizing drivers when they were cut off on the roads, data which was then used by Amazon to assess the driving abilities of each driver and to decide how much extra pay they should receive.

Matus stated that Fairmatic only pays attention to data that is associated with the insurance policy, such as data that is necessary for risk and claims administration. Additionally, he mentioned that Fairmatic’s technology is designed to use anonymous information and does not keep driver details without the authorization of the fleet.

In spite of everything, Fairmatic has had no difficulty in gaining the attention of investors or clients. This week, they completed a financing round that was driven by Battery Ventures, with involvement from current financiers and Bridge Bank, which brought the total amount of funding to $88 million, and doubled their previous worth (Matus declined to give the exact figure). On the customer side, Matus has reported that they have enlisted “hundreds of thousands” of drivers.

It is not unexpected that commercial auto insurance is a very large market. Allied Market Research estimates the industry will be worth $307.10 billion by 2030, up from $128.44 billion in 2020. Even with the risk of bias, money speaks volumes, and this is especially true now when global insurtech venture capital is slowing down.

Fairmatic intends to add 30 workers to their research and development center in Israel and more in Bangalore, India, according to Matus. The company’s current personnel, located in offices in the United States, Israel, and India, is at a total of 85 employees.

Matus stated that Fairmatic experienced rapid growth after their Series A, and this extra capital will be used to further their progress in incorporating AI into the commercial auto insurance sector. The company is making strategic hires globally and is speeding up the development of their research and development centers in Israel and India. Their ultimate goal is to create a tech-driven insurance platform that is completely digital and enhanced with AI for all products and operations.