Mythic, an AI chip business that was supposedly without funds in November, reemerged on this day with a surprising investment of new capital.

This morning, Mythic reported that they have closed a round of financing worth $13 million. Both Atreides Management, DCVC and Lux Capital, pre-existing investors in Mythic, and Catapult Ventures and Hermann Hauser Investment, new investors, contributed to this. Although the sum is a lot lower than their previous raising of $70 million, Mythic has stated that the money should be enough to launch their highly advanced, power-efficient AI processor.

Dave Fick, newly appointed CEO at Mythic, stated to TechCrunch in an email that given the current tough economic situation, this new source of funding will assist Mythic in concentrating on its tech offering, their go-to-market strategy, and the procurement of customers.

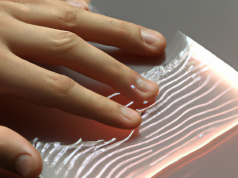

Fick and Mike Henry originated Isocline, which later became known as Mythic, at the University of Michigan. This company specializes in chip technology that preserves analog information on flash transistors. In contrast to digital processors that require pauses for information to be retrieved from memory, Mythic’s hardware can achieve calculations at the same time without ceasing and is supposed to bring obvious advancements in execution and productivity, particularly for Artificial Intelligence related applications.

Mythic began by conducting projects commissioned by the Small Business Innovation Research (SBIR) branch of the US Air Force, concentrated on making use of computer vision for unmanned aerial vehicles flying at high altitudes and picking up GPS signals. When the contracts ended, Mythic turned to venture capitalists for money and was able to secure into excess of $170 million in multiple rounds, with contributions from investors, like Hewlett Packard Enterprise and BlackRock.

Mythic utilized its inaugural business chip, M1076, to increase its focus on computer vision applications, devising a system that has the potential to detect tiny items from far away within a time period of less than 33 milliseconds. This characteristic likely resulted in the greatest client that it has served to date, Lockheed Martin, to become an important stakeholder in the startup as its Private Equity, Lockheed Martin Ventures, was involved.

It seems that Mythic had a lot of competition from similar startups in the AI chip field. Nonetheless, that competition has not been able to obtain enough funding for the projects, due to a decrease in global VC equity for semiconductor startups, which decreased to $7.8 billion in 2022.

Mythic was not the lone casualty of the financial downturn. AI chip manufacturer Graphcore revealed that its valuation had decreased by a billion dollars after an arrangement with Microsoft went awry. On top of that, they mentioned that they would have to reduce their staff due to the harsh economic climate. Similarly, another AI chip maker, Habana Labs, owned by Intel, laid off an estimated 10% of its employees.

Fick took the initiative to regain control over the company’s stability and employed cost-effective methods to do so. As part of this effort, Mythic sought to utilize outside resources and pre-existing parts to reduce expenses and hopefully speed up the process for launching products.

Fick claims that the change in organization can help Mythic´s R&D become more reactive as it works to bring out their new M2000 chip.

Fick commented that the new economic climate likely means that many startups, particularly system firms requiring a wide array of components beyond their core technology, will imitate this approach. He emphasized that one advantage of Mythic’s analog computing tactic is that they can use older and more attainable process nodes. These are more affordable than more advanced nodes and have more resources available.

Apart from cost reduction, Mythic returned to its original methods and concentrated mainly on the defense sector and to a lesser extent, the public safety, industrial and consumer spaces, stated Fick, who did not provide further details. This arguably implies that they are aiming for more customers who own government contracts, much like Lockheed.

Fick mentioned that due to the lack of cloud computing in a combat situation, less powerful yet more cost efficient edge computing must be utilized. Furthermore, due to the M2000’s remarkable ability to reduce size, weight, power and cost concerning its computer vision capabilities, it can be employed to a larger number of contexts, such as drones, radar, augmented reality headsets etc.

Certain people might accuse Mythic of taking advantage of the current shift in defense investments but no one can deny the influx of funding there. PitchBook reported recently that after a long period of avoid investments in military and security startups, venture capitalists are digging into the industry as the U.S. works to get an advantage over aggressive nations such as China and Russia. By October 13 of 2022, U.S. aerospace and defense companies gained an investment of $7 billion, which appears to surpass the prior year’s highest total of $7.6 billion.

Matt Ocko, the managing partner of DCVC, stated in a dramatic way that Mythic’s processor provides a GPU performance that can be placed in the size, power, and cost of equipment that can defend schools, public places, and allied soldiers in times of war. He added that Mythic’s technological advancements can bridge the gap between what is expected and what is achievable. Researchers in the field of artificial intelligence produce written work which is different from the systems that are created and utilized for homeland defense and national security, providing groundbreaking features.

Sifting through the excitement, investors are optimistic about Mythic’s move to focus on defence – for the moment. Whether it was the ideal decision will be revealed over time.